Thinking of buying an open plot on loan? Here is all you need to know.

Investing in land is always a good idea, as the value of land increases steadily over the long term. This gives you a better return on investment when you sell the property. In India, people purchase land or plots of land for various purposes, with investment being the primary reason. Banks also extend you a loan for the purchase of the plot, which can be repaid in Equated Monthly Instalments (EMI). Plot loans come with features such as easy repayment terms and flexible EMIs. You can use a plot loan calculator to estimate your monthly repayments.

A Few Key Points on Plot Loans

Affordable plot loans with an interest rate of 7.95% per annum*

Low processing fees, varying between 0.5% to 3%*

Loan to value ratio – 80:20

No tax benefits on empty plots, however, one can get tax benefits once they finish constructing a house/building on the plot purchased (under section 80C and section 24)

The maximum loan tenure of the plot is 20 years

No prepayment charges

Loan-to-value ratio

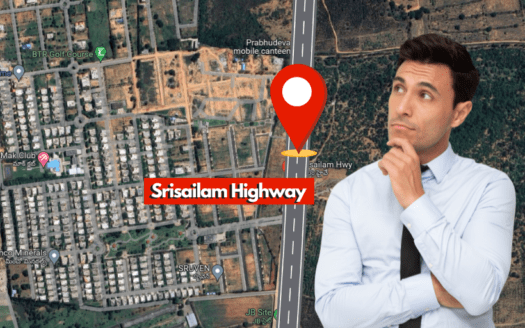

The loan-to-value ratio or LTV of a plot is the percentage of the property’s value that can be financed by the lender. Usually, lenders offer a maximum of 80% for plots. However, the final LTV ratio that a borrower can get depends on the credit risk assessment that the lender performs. Besides the property’s location and credit profile, other factors such as the borrower’s repayment capacity and market value are also taken into account to arrive at a final LTV ratio.

Loan tenure

Most lenders offer plots with varying tenures ranging from 10 to 20 years. They would consider an applicant’s repayment capacity when setting the loan’s terms. In addition, they would typically require that the applicants maintain their monthly income contribution of at least 50% of their net monthly income.

Tax deductions

No income tax deductions are allowed for the repayment of principal and interest on a plot loan. However, these deductions may be claimed for a home loan taken to construct a residential property on the purchased plot.

Processing and prepayment charges

The processing fees that a lender charges for a plot loan are typically between 0.25% and 1.50% of the loan amount. However, since the Reserve Bank of India has restricted lenders from charging these fees on floating rate loans, they are free to charge or waive them on fixed-rate loans.

Who are eligible for land loans?

Resident Indians and NRIs

Aged between 18 and 70 years

Salaried, self-employed, and/or business owners

Applicants whose credit score is more than 750 have higher chances of availing of plot loans.

At VBVR properties, we help our customers with the purchase of property, registration, and document verification with the right guidance and assistance. To know more about open plots for investment in Hyderabad or for an inquiry about a property connect with us today.