Buying an Open Plot vs. Buying a Flat: Which Offers Greater Appreciation in Asset Value?

When it comes to investing in real estate, one of the key considerations is the potential appreciation in asset value. Both open plots and flats offer their own set of advantages and disadvantages, but if you are looking for greater appreciation in asset value, buying an open plot can be a wise choice. In this blog post, we will delve into the reasons why open plots tend to offer better yields in terms of appreciation compared to flats.

Land Scarcity and Demand:

The scarcity of land is an important factor driving the appreciation in asset value. As urbanization continues to grow, the availability of open plots decreases over time. On the other hand, flats can be built vertically, utilizing limited land resources more efficiently. This fundamental scarcity of land contributes to the higher demand for open plots, which in turn drives their value upwards. As the population increases and cities expand, the demand for open plots will continue to rise, ensuring a steady appreciation in their asset value.

Flexibility in Development:

Open plots offer greater flexibility in terms of development possibilities compared to flats. When you purchase an open plot, you have the freedom to design and construct a property according to your preferences and needs. This customization potential allows you to maximize the value of the land by building a unique and tailored structure. By contrast, flats are typically part of a larger development project, where individual customization options are limited. The ability to create a bespoke property on an open plot gives it an edge in terms of appreciation potential.

Future Infrastructure Developments:

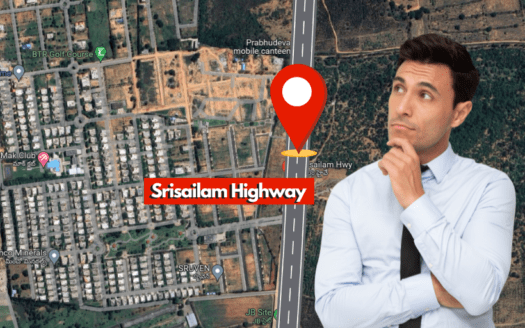

Open plots tend to benefit from future infrastructure developments. As cities expand, new roads, bridges, highways, and public transportation systems are often planned and constructed. These developments can significantly enhance the accessibility and desirability of the areas where open plots are located. Improved infrastructure leads to increased demand for properties in those regions, consequently driving up the value of open plots. Flats, on the other hand, may not always experience the same level of appreciation as open plots due to limited scope for infrastructure improvements within an already built-up area.

Diverse Usage Options:

Open plots provide diverse usage options that can add value and appreciation potential. Depending on the location and local regulations, you can explore various avenues such as residential, commercial, or mixed-use development. By carefully considering market trends and demands, you can leverage the flexibility of an open plot to generate higher returns on your investment. Flats, on the other hand, are typically limited to residential purposes, which may restrict their potential for appreciating in asset value as compared to open plots.

Conclusion:

While both open plots and flats have their own merits, if you are seeking greater appreciation in asset value, investing in an open plot can be a wise decision. The scarcity of land, flexibility in development, future infrastructure developments, and diverse usage options all contribute to the potential for higher yields when it comes to open plots.

As with any investment, thorough research, careful planning, and understanding of the local real estate market are essential to maximize the appreciation potential of your chosen property.