First Time Home Buyers: A Comprehensive Guide to Making Your Dream a Reality

Table of Contents

- Introduction

- Understanding the Importance of Being a First-Time Home Buyer

- Assessing Your Financial Readiness

- Setting a Budget

- Saving for a Down Payment

- Understanding Your Credit Score

- Exploring Different Mortgage Options

- Fixed-Rate Mortgages

- Adjustable-Rate Mortgages

- FHA Loans

- VA Loans

- Researching the Real Estate Market

- Location, Location, Location

- Property Types and Styles

- Hiring a Real Estate Agent

- The Home Search Process

- Defining Your Needs and Wants

- Attending Open Houses and Showings

- Making Offers and Negotiating

- The Home Inspection and Closing Process

- Importance of a Home Inspection

- Navigating the Closing Process

- Moving In and Making Your House a Home

- Tips for a Smooth Move

- Personalizing Your New Space

- Building a Strong Community Network

- Common Challenges for First-Time Home Buyers and How to Overcome Them

- Financial Constraints

- Emotional Decision-Making

- Dealing with Competition

- Conclusion

Introduction

Congratulations on taking the exciting step towards homeownership! Being a first-time home buyer is an incredible milestone, but it can also be an overwhelming experience. This article will guide you through the process of buying your first home, providing valuable insights and tips to make your journey smoother and more enjoyable.

Understanding the Importance of Being a First-Time Home Buyer

Before diving into the details, it’s essential to recognize the significance of being a first-time home buyer. Owning a home brings stability, financial benefits, and a sense of pride in ownership. It’s a substantial long-term investment that can lead to greater financial security and personal satisfaction.

Assessing Your Financial Readiness

Setting a Budget

One of the first steps in buying a home is setting a realistic budget. Consider your monthly income, expenses, and savings goals. Your budget will determine the price range for your potential new home.

Saving for a Down Payment

Saving for a down payment is a crucial aspect of homeownership. The more you can put down upfront, the lower your mortgage payments will be. Explore different down payment assistance programs if needed.

Understanding Your Credit Score

Your credit score plays a significant role in securing a mortgage with favorable terms. Check your credit report, identify areas for improvement, and work on boosting your score before applying for a loan.

Exploring Different Mortgage Options

There are various mortgage options available for first-time home buyers. Understanding each option will help you make an informed decision.

Fixed-Rate Mortgages

Fixed-rate mortgages offer stable interest rates throughout the loan term, providing predictability in monthly payments.

Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) have interest rates that fluctuate based on market conditions. While they often start with lower rates, they can increase over time.

FHA Loans

FHA loans are backed by the Federal Housing Administration and offer low down payment options, making them attractive to first-time home buyers.

VA Loans

Available to veterans and active-duty military personnel, VA loans offer competitive interest rates and flexible qualification requirements.

Researching the Real Estate Market

Location, Location, Location

The location of your potential home is a crucial factor to consider. Research different neighborhoods, amenities, schools, and transportation options.

Property Types and Styles

Explore the various property types and styles available in your desired area. Whether you prefer a single-family home, condominium, or townhouse, understanding your options is essential.

Hiring a Real Estate Agent

A professional real estate agent can be an invaluable asset throughout your home-buying journey. They can help you find suitable properties, negotiate offers, and navigate the paperwork.

The Home Search Process

Defining Your Needs and Wants

Create a list of must-have features and preferred amenities for your future home. This will help narrow down your options and focus your search.

Attending Open Houses and Showings

Visiting open houses and showings allows you to get a feel for different properties. Take notes and ask questions to gather all necessary information.

Making Offers and Negotiating

When you find the perfect home, work with your real estate agent to make a competitive offer. Negotiation may be required, so be prepared for counteroffers.

The Home Inspection and Closing Process

Importance of a Home Inspection

A home inspection is crucial to identify any potential issues with the property. It gives you the opportunity to request repairs or renegotiate the price before closing.

Navigating the Closing Process

The closing process involves reviewing and signing various documents. Ensure you understand all the terms and costs involved.

Moving In and Making Your House a Home

Tips for a Smooth Move

Plan your move carefully, hire reputable movers, and consider packing strategically to minimize stress.

Personalizing Your New Space

Decorate and furnish your home to reflect your style and personality. This is your chance to create a space that truly feels like home.

Building a Strong Community Network

Get involved in your new community by attending local events, joining clubs, and meeting your neighbors. Building a network can help you feel more at home.

Common Challenges for First-Time Home Buyers and How to Overcome Them

Financial Constraints

Many first-time homebuyers face financial challenges. Stick to your budget and explore assistance programs to overcome this hurdle.

Emotional Decision-Making

Buying a home is an emotional process. Stay focused on your needs and priorities to avoid making impulsive decisions.

Dealing with Competition

In a competitive real estate market, you may face bidding wars. Be patient and prepared to adjust your strategy.

Conclusion

Purchasing your first home is a significant achievement that comes with great rewards and responsibilities. By following this guide, you’ll be better prepared to navigate the home-buying process confidently. Remember to stay informed, be patient, and seek professional guidance when needed. Happy house hunting!

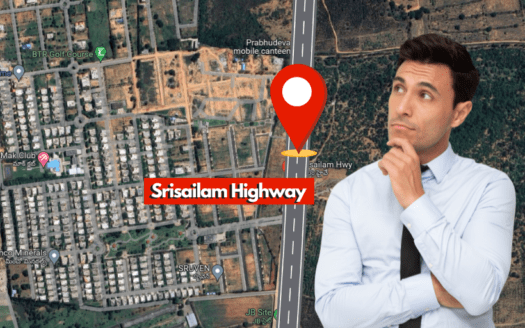

VBVR Projects has been built on the foundation of making people’s dreams come true. We offer end-to-end real estate services, from property identification and loan processing to registration and resale. Our expert team will help you every step of the way to make your dream home a reality.

Contact us for a FREE consultation. 7287 898 898

FAQs

- Is it necessary to have a perfect credit score to buy a home?

- While a higher credit score can offer better mortgage options, there are loans available for individuals with less-than-perfect credit.

- What is the typical down payment for first-time homebuyers?

- The down payment amount varies but is often around 3% to 20% of the home’s purchase price.

- How long does the home-buying process usually take?

- The timeline can vary, but on average, it takes about 30 to 45 days from offer acceptance to closing.

- Can I negotiate the asking price of a home?

- Yes, negotiation is common in the real estate market. Your real estate agent can help you navigate this process.

- Are there any government incentives for first-time home buyers?

- Yes, some government programs offer incentives, grants, or tax credits to help first-time home buyers with their purchases—research available programs in your area.